However the implementation of the thin capitalization rules was deferred to the end of December 2017 and eliminated on 1 January 2018. Tax Audit Framework On Withholding Tax available in Malay version only 01082015.

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Donations to certain charitable organisations approved as public benefit organisations are tax deductible up to a maximum of 10 of taxable.

. Value Added Tax VAT. Which you fall in and the long-term capital gain tax is 20 percent. Tax Audit Framework On Finance and Insurance Superceded by the Tax Audit Framework On Finance and Insurance 18112020 - Refer Year 2020.

Goods Services Tax GST Professional Tax. As of 2021 15 tax rate is applied for the disposal of securities and sale of property. Do more with Standard Chartered Malaysias e-banking.

And the individual will be liable to pay the Danish tax due on this unrealised gain this is so-called. Any bad debts arising on loaned money is deductible if it was lent in the course of a money-lending business. If you make a capital gain on the sale of your investment property you need to pay tax on this profit.

Property value tax is charged on both Danish properties and properties situated in another country. Property value tax. Real Property Gains Tax Act 1976 RPGT Act which imposes tax on profits from the disposal of real properties in Malaysia and shares in real property companies RPC.

Gain access to the widest range of unit trusts in Malaysia with the Standard Chartered Wealth Management. Capital Gains Tax on Transfer of Property. Mr Porter said.

For property placed in service in tax years beginning after December 31 2017 the Act increased the dollar limitation to 1 million while increasing the cost of property subject to the phase-out to 25 million. The new dollar limitations are indexed for inflation for tax years beginning after December 31 2018. August 16 2018 More Change of Majlis Perbandaran Nilai MPN and Unifi payment service.

Is a country in Southeast AsiaThe federal constitutional monarchy consists of thirteen states and three federal territories separated by the South China Sea into two regions Peninsular Malaysia and Borneos East MalaysiaPeninsular Malaysia shares a land and maritime border with Thailand and maritime. If you bought and sold your property within 12 months your net capital gain is simply added to your taxable income which in turn increases the amount of income tax you pay. Malaysia m ə ˈ l eɪ z i ə-ʒ ə mə-LAY-zee-ə -zhə.

A tax allowance is also provided for in respect of doubtful debts. Introduced to the ITA. Properties that are rented out are not subject to property value tax regardless of where the property is situated.

Malaysia and the US has signed the IGA on a Model 1 to implement FATCA on 21 July 2021. Capital gains tax is charged on the profits or. While the Capital Gain Tax is imposed on the gains presumed to have been realized by the seller from the sale.

Capital Gains Tax Rates for Fiscal Year 201718 Assessment Year 201819 Assets. Capital gains tax discount. Tax Audit Framework Superceded by the Tax Audit Framework 01052017.

Most countries have some form of main home tax relief so in the normal course of events no capital gains tax arises on. Sales tax immovable property transfer tax etc. Accordingly Malaysia has been included in the US Department of Treasurys list of jurisdictions that are treated as having an IGA in effect with the US.

In the 2017 amendment of the government under section 11A of the act it was inserted that there should be crèche facility in any establishment having more than fifty employees and the employee shall be allowed to visit the crèche four times a day. The interesting thing about the capital gain tax is that the profit does not always should be in the money form. There is no capital gains tax for.

TRANSFER PRICING -- A transfer price is the price charged by a company for goods services or intangible property to a subsidiary or other related company. We refer to the announcement by the Government of Malaysia on 12 June 2018 Malaysias Commitment in International Tax Standard and the subsequent announcement by MDEC on 28 December 2018 titled Important Update and Changes on MSC Malaysia BOG 5. Abusive transfer pricing occurs when income and.

TRANSACTION TAXES -- Tax that uses a specific type of transaction as its object eg. Thus A has been allocated a total of 6000 of tax gain -- which matches the 6000 of appreciation that was in the land before A contributed it to the LLC -- and B is made whole by being. The list of jurisdictions can be found by clicking on the following link.

Malaysia Sustainability Summary 2017 Effective.

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Income Tax Law Changes What Advisors Need To Know

All You Need To Know About Real Property Gains Tax Rpgt

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

Tax Treatment On Digital Advertising Provided By A Non Resident

Irb Ceo Govt Should Consider Introducing Capital Gains Tax The Edge Markets

Income Estate Capital Gains Tax Hikes Retirement Account Crackdown House Finally Details How It Will Fund 3 5 Trillion Social Policy Plan

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Taxation On Property Gain 2021 In Malaysia

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Real Property Gains Tax Rpgt Gl Property Consultancy Facebook

Real Property Gains Tax 101 Malaysian Taxation 101

Taxation On Property Gain 2021 In Malaysia

Real Property Gains Tax Part 1 Acca Global

Real Property Gains Tax Rpgt In Malaysia Tax Updates Budget Business News

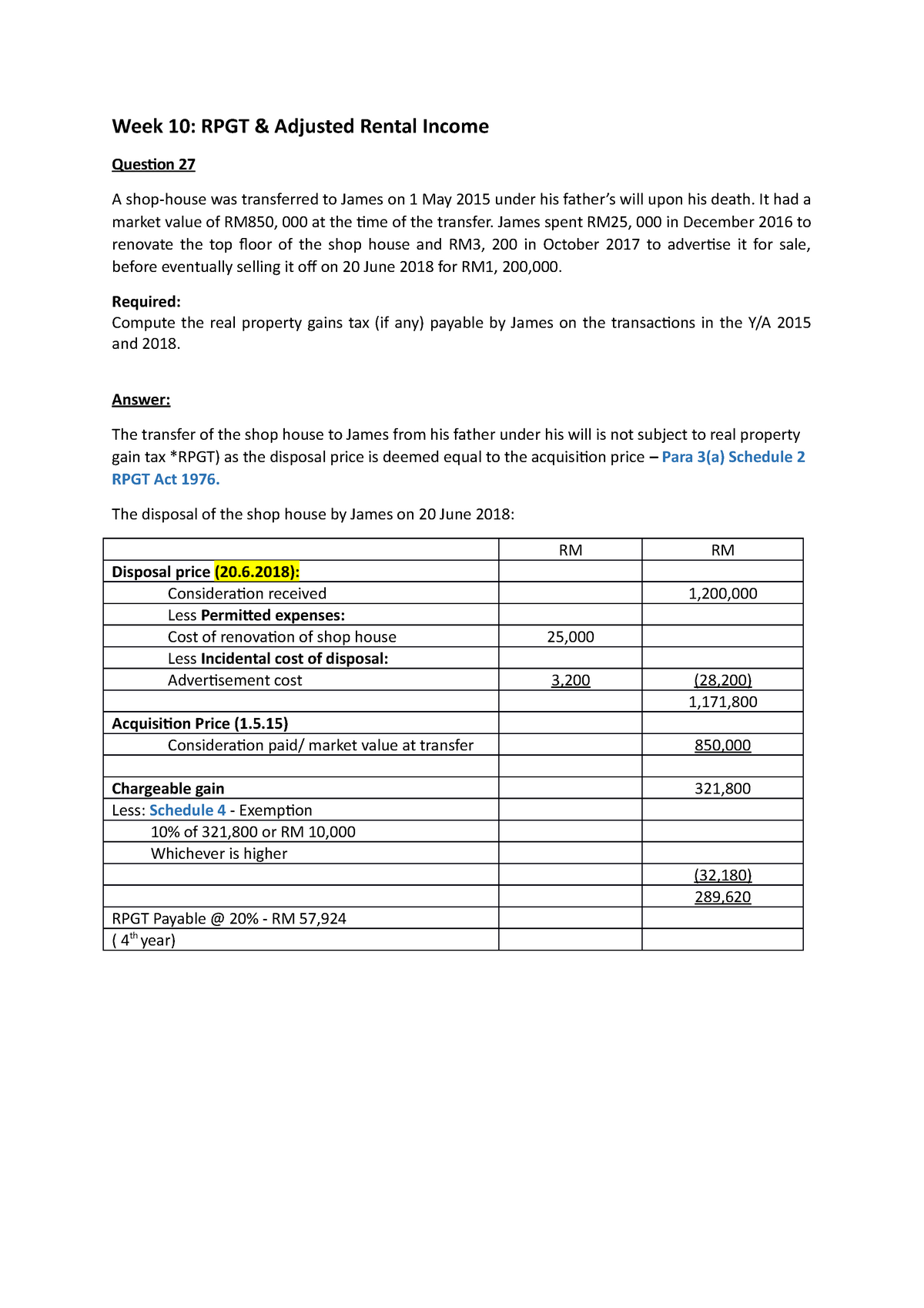

Rpgt Rpgt Answers Week 10 Rpgt Amp Adjusted Rental Income Question 27 A Shop House Was Studocu

U S Estate Tax For Canadians Manulife Investment Management

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan